Growth Guarantee Scheme (GGS)

- Fast approval processes mean you can secure the funding you need in no-time

- The government-backed guarantee lowers the risk for lenders, making it easier for businesses to obtain loans, even without substantial collateral

- Loans under the Growth Guarantee Scheme come with customisable repayment options to suit your business’s cash flow and financial situation

- Whether you’re expanding your team, investing in technology, or opening new locations, the scheme helps you access the capital necessary to fuel your growth

So don’t wait, speak to a member of our business finance team today.

We are FCA Authorised & Regulated

(Number: 802921)

What is the Growth Guarantee Scheme?

The Growth Guarantee Scheme offered by V4B Business Finance provides a unique opportunity for businesses looking to expand, invest in new projects, or improve cash flow. This government-backed funding solution is designed to offer businesses the financial support they need to reach new heights while minimising risk. Whether you’re looking to hire more staff, purchase new equipment, or explore new markets, this scheme can be a game-changer for your growth journey.

The Growth Guarantee Scheme (GGS) is a government-backed initiative designed to provide easier access to financing for UK small businesses looking to grow and invest. Launched on July 1, 2024, as a successor to the Recovery Loan Scheme, the GGS aims to offer more favourable loan terms. Even if your business has previously used CBILS, BBLS, or RLS loans, you may still apply for the GGS, though borrowing limits may be adjusted. All applications are subject to credit and fraud checks, with loan approvals at the discretion of the lender.

Business Growth Loans – Case Study

Businesses can face a variety of problems, but one that most companies never expect is to become too successful. We regularly speak with businesses that need financing because they have seen demand outstrip their ability to supply customers and there is where a business growth loan can come in.

Find out more in the case study

Who Can Apply?

The Growth Guarantee Scheme is designed for established businesses that have a clear growth plan but need financial support to execute it. Whether you’re in retail, construction, technology, or services, this funding can help you meet your goals. V4B Business Finance welcomes applications from a variety of industries, helping businesses across sectors thrive.

Am I Eligible?

- Turnover of less than £45 million

- Trading in the UK for at least 2 years

- Must be a limited company

- Loan must be for business purposes (e.g., working capital, investment)

- Must not be in financial difficulty or undergoing insolvency proceedings.

Common Growth Guarantee Scheme Questions

How do Business Loans Differ From Personal Loans?

Business loans and personal loans differ primarily in their purpose, eligibility criteria, and loan terms.

For instance, Business loans, or business funding, are designed specifically for business-related expenses, such as expanding operations, purchasing equipment, or managing cash flow. Consequently, this type of loan often requires a detailed business plan and financial statements.

Personal loans, on the other hand, are intended for individual needs, like home renovations or debt consolidation, and typically rely on the borrower’s personal credit history and credit rating.

Additionally, business loans may offer larger loan amounts and longer repayment terms than personal loans, reflecting the scale and nature of your business financing needs, for instance.

What is the Difference Between a Variable and Fixed Rate Business Loan?

Variable-rate business loans have interest rates that fluctuate with market conditions — such as when the Bank of England decides to increase or decrease the base rate — leading to potential changes in monthly payments.

Fixed-rate business loans, on the other hand, maintain a consistent interest rate throughout the loan term, providing predictable monthly payments.

Consequently, Fixed rates offer you stability, while variable rates can benefit you from lower interest periods but come with the risk of rate increases.

Why Choose Our Business Funding Options?

Here at V4B, we have been in operation for a long time, so there are a lot of reasons to choose us as your company financing provider, such as for instance:

Flexible Repayment Terms

We offer a range of repayment terms to suit your business needs, from short-term to long-term loans. Our fixed interest rate ensures predictable monthly repayments.

Easy Application Process

Our straightforward application process is designed to get you the funds you need quickly. Simply fill out our online form, and we’ll guide you through the rest.

Competitive Rates

With rates that reflect your credit history and business performance, you can be confident you’re getting a fair deal. Use our business loan calculator to estimate your monthly payments and the total amount repayable.

Support for All Business Types

Whether you are a limited company, a sole trader, a Limited Liability Partnership, or someone looking for a startup loan for a new business idea, we have loan options that fit your business structure and needs.

Businesses That Can Benefit From Growth Guarantee Scheme

Kickstart new building projects, all while you manage your cash flow throughout your construction project as well.

Find out how asset finance can benefit Breweries, Microbreweries & Distilleries.

Covers invoicing shortfalls, and provide you with a steady income through more uncertain months.

Buys the seeds, feed you need, get your crops growing quickly, & fund the purchase of machinery you need to make your work easier.

Business circumstances can change at the drop of a hat. Preparing for foreseeable expenses such as quarterly VAT bills, planned expansion or corporation tax can be accounted for in the...

Improve your construction equipment, improve your production efficiency, & maintain your supplier relationships with on-time payments

Get the tools you need to move your business forward, with flexible repayment options that suit your budget.

Buy new vehicles or equipment that you need now, with fast funding to grow your logistics business, and an easy application process with minimal paperwork.

Buy the raw materials you need without hitting your cashflow, while you keep your machines running without worrying about any short term maintenance and upkeep as well.

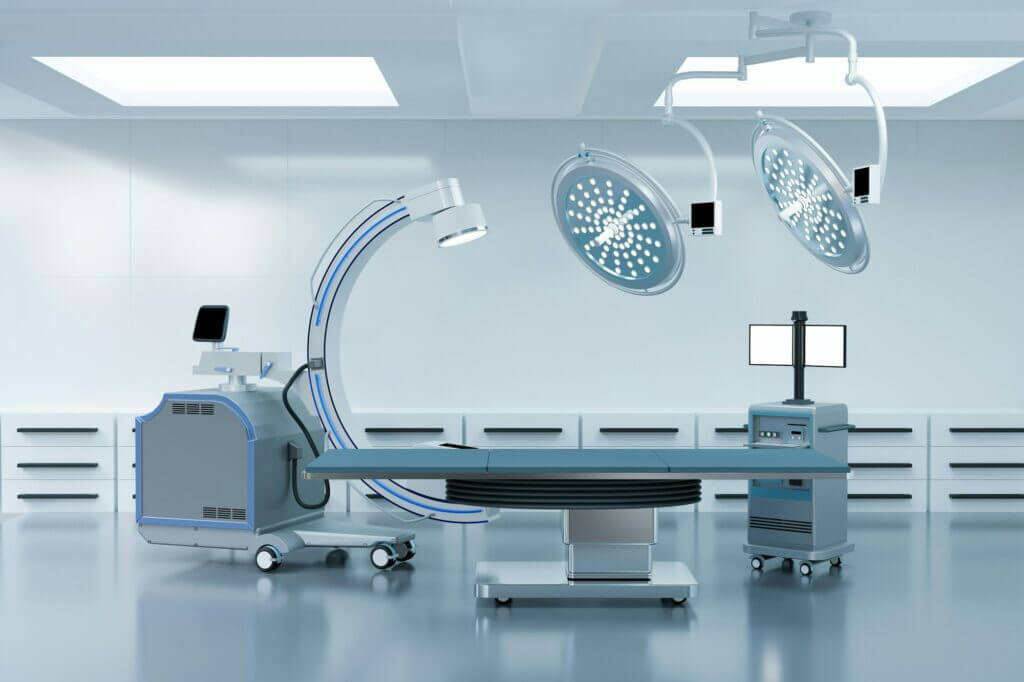

Help to grow or upgrade your practice easily, and upgrade your medial & dental equipment, refurbishments or even staff costs.

Grow, modernise and upgrade your care home business, while you improve your facilities for better resident comfort & support, & hire more care staff to be able to give better care.

Grow your green energy business faster then otherwise, with quick approval to get things moving sooner to support your eco-friendly and sustainable construction goals.

No more waiting on your client payments & keep your legal firm running smoothly with it being tailored just for legal professionals.

Buy better equipment & get the tools or machines you need without spending all your cash upfront to do so.

The Growth Guarantee Scheme Explained

So, you have heard about the UK’s Growth Guarantee Scheme and are wondering how you can utilise this for your business. Well, you are in the right a place, so let’s find out how it can benefit you.

What is the Growth Guarantee Scheme?

As you can see, the Growth Guarantee Scheme is a UK government-backed initiative aimed at encouraging accredited lenders – including banks and financial institutions – to offer loans to small and medium-sized enterprises (SMEs) and start-ups.

This scheme is managed by the British Business Bank with the financial backing of the Secretary of State for Business, Energy & Industrial Strategy.

These Government-backed business support activities, do so by providing you with a government-backed guarantee on a portion of the loan, which then acts as a safety net for our lenders in case of defaults.

It does so by reducing lender risk, as the scheme opens the door for more businesses to secure funding – even those that might otherwise struggle to meet traditional lending criteria, provided you have a viable business proposition and meet the eligibility criteria that is.

Then, all borrowers who receive a subsidy from a publicly funded programme such as this will also be given a written statement that confirms the amount and type of loan they will get.

How Did The Growth Guarantee Scheme Come About?

The UK government, through HM Government and the British Business Bank plc, introduced the Growth Guarantee Scheme as part of a broader economic recovery effort in 2024 – especially post-pandemic when many businesses found it difficult to access credit.

Building on the foundations of previous initiatives, this is the successor scheme to the Bounce Back Loan Scheme, the Coronavirus Business Interruption Loan Scheme, and the Recovery Loan Scheme; the Growth Guarantee Scheme is really designed to stimulate economic growth.

Its main aim is to encourage British innovation and company expansion across various industries by helping businesses with the financial backing they need to grow to help the economy.

Why Are Business Loan Companies Adopting this Scheme?

Accredited lenders, including banks and Building Societies offering commercial loans, are incentivised to make use of the Growth Guarantee Scheme because it allows them to extend credit to businesses with less risk than standard credit arrangements do.

The guarantee from the government then covers a significant portion of the loan in case of non-payment – reducing the need for personal guarantees and extensive fraud checks to then need to occur.

This makes it a win-win for both the lender and the borrower as an end result.

Key Facts of the Growth Guarantee Scheme

- ✔ A Government-backed guarantee for up to 80% of the loan amount against the outstanding balance of the facility, reducing lender risk in the process.

- ✔ Gives you options for longer repayment periods, which can be more customised to your business needs, which in turn offers you better terms than standard credit does.

- ✔ Includes term loans, invoice finance, and other debt-finance solutions.

- ✔ The maximum amount of a loan facility you get is designed to suit different stages of business growth, from start-ups to scaling enterprises.

- ✔ Available to a large number of smaller businesses and UK small businesses meeting the eligibility criteria.

So How Does the Growth Guarantee Scheme Work?

The Growth Guarantee Scheme works by offering government-backed guarantees on various types of business finance provided by financial institutions, including term loans, invoice finance, and other debt-finance options for example.

Typically, the government will guarantee a portion — often up to 80% — of the loan, with a maximum amount of a facility depending on the business’s turnover limit and subsidy limits.

The interest rates are then determined by the lenders but are often more favourable due to the reduced risk that they will need to take on.

This then helps them in the case of borrower defaults, as the lender can recover a significant part of the loan from the Government under the scheme if they need to.

What is The Role of the UK Government in Supporting Businesses Via This?

Through HM Government’s publicly funded programme, the Growth Guarantee Scheme gives significant government-backed business support to many businesses.

By backing loans, the UK government is aiming to support businesses at all stages, from fledgling start-ups to established companies seeking to expand and create more jobs.

When many companies may lack sufficient collateral to secure traditional loans, this really is designed to help support businesses to help them get access and financial backing to maintain and grow their trading activity and help the UK economy grow as a result.

Understanding the Guarantee Element for Business Loans

For loan companies, the guarantee provided by the scheme reduces the need for personal guarantees or security over Principal Private Residences.

The guarantee can also be given on a group basis as well, meaning that businesses that are part of a wider group, or business group, can also benefit as well.

It does so by helping to reassure lenders that the majority of their capital is safe – encouraging them to extend credit even to businesses with higher risk profiles as a result.

What are the Eligibility Criteria for Businesses?

Small and medium-sized enterprises (SMEs), start-ups, and even established companies can apply for loans under this scheme, including those based in Northern Ireland (Northern Ireland Protocol borrowers).

However, we should not forget that certain entities, such as public sector bodies and secondary schools, are generally excluded.

Businesses must also not be undergoing relevant insolvency proceedings and should demonstrate active trading activity as well.

The focus is purely on businesses that are growth-oriented and need funding to expand – whether that be through new product development, market expansion, or operational scaling to put the eligibility criteria into context.

How Do You Apply for the Growth Guarantee Scheme?

Applying for the Growth Guarantee Scheme is really easy.

For instance:

Step 1 - Determine Your Eligibility

First, we need to determine your eligibility by reviewing your business’s financials and previous subsidies to make sure they align with the scheme’s eligibility criteria that we can help you through.

Step 3 - We Contact Accredited Lender

Step 5 - Money in your account

Step 2 - Documentation

Next, we will let you know what documentation we need and then get all the necessary documentation ready – including your comprehensive business plan, financial statements, and growth forecasts ready for our lender’s approval.

Step 4 - Loan Completion

Documentation and Requirements for Businesses

To be suitable, businesses must submit key financial documents such as profit and loss statements, tax returns, and growth forecasts.

It is essential at this stage to demonstrate that your business is a viable business proposition and is not undergoing any relevant insolvency proceedings.

Consequently, having a well-documented business plan is also key to showing how the loan will contribute to your growth and how you plan to repay the loan over its duration as well.

We should also note that all borrowers must also provide written confirmation that receiving support from the Growth Guarantee Scheme facility will not cause their business to go over the maximum amount of subsidy they are allowed to receive.

what Are The Expectations, Timelines and Approval Process?

Realistically, you can expect the approval timeline to typically take from a few days to a few weeks – depending on the accredited lender and the complexity of the loan request being made.

Due to reduced risk and the streamlined processes this scheme sets out, including simplified fraud checks, applications under the Growth Guarantee Scheme can be processed more quickly than standard credit applications due to this.

What Industries Are Best Served by the Growth Guarantee Scheme?

While businesses across all sectors are encouraged to apply, industries such as manufacturing, technology, retail, and green energy will tend to benefit most from the scheme.

This is because these sectors often have large upfront capital needs, which can stifle business growth; consequently, they can leverage the scheme to fuel their expansion as a result

Financial service providers like insurance brokers and even development banks can then participate in the scheme as accredited lenders by helping to provide finance to a diverse range of businesses.

How Can SMEs and Start-ups Best Leverage the Scheme?

For SMEs and start-ups, the Growth Guarantee Scheme is also an ideal way to secure much-needed capital without the high barriers often associated with traditional lending.

For instance, you can access funding that can significantly improve cash flow and provide better terms than would otherwise be available to you.

The scheme also considers any previous subsidy received by the business over a rolling three-year period when determining the maximum amount available.

By utilising the guarantee, your business can then grow more confidently, especially knowing that the government’s backing you, which helps to reduce the risk to your lender as a result.

What Does This Encourage UK Business Loan Providers To Increase Lending?

As you can see, the guarantee structure in place helps to reduce the risk exposure for lenders, who can rely on the government-backed guarantee in the event of borrower default.

This reduces the need for extensive fraud checks compared to standard credit applications, and the lender can proceed knowing that the borrower’s receipt of a subsidy under the scheme also further supports the loan’s security as a result.

Which in turn helps to encourage lenders to provide loans to a wider range of businesses – including those that may have a higher risk profile due to limited credit history or available collateral as well.

Improves The Ability for Business to Gets Access to Business Loans

With reduced risks, our accredited lenders are then more willing to offer you favourable terms that wouldn’t historically be available – such as lower interest rates or extended repayment periods, for example.

These are then better terms than the standard credit facilities available, making business loans are then more accessible and affordable to you as a UK business, helping you to grow and expand as an end result.

Attracts New Business Borrowers

Another benefit to financial institutions is that the scheme helps attract new business borrowers that they wouldn’t have had prior, including those within a wider group or business group as well, by offering them a more appealing and less risky proposition on a group basis.

It also enables our lenders to diversify their loan portfolios and support a broader spectrum of businesses improving their client base at the same time.

Growth Guarantee Scheme vs. Bounce Back Loan Scheme How Does It Differ?

The Bounce Back Loan Scheme offered loans with 100% government guarantees – primarily targeting smaller businesses during the immediate pandemic response.

The Growth Guarantee Scheme is the successor to this scheme, giving you a more sustainable, growth-focused approach with better terms for larger businesses, especially this time around.

Similarly, the Coronavirus Large Business Interruption Loan Scheme (CLBILS) supported larger companies, and now the Growth Guarantee Scheme continues this support but under a more unified framework.

Consequently, the Growth Guarantee Scheme addresses the needs of both small and large businesses, including those classified as Coronavirus Large Business borrowers as well.

Why is the Growth Guarantee Scheme is Preferred for Business Growth?

Unlike other schemes, the Growth Guarantee Scheme is specifically designed to help businesses grow and expand by providing Growth Guarantee Scheme-backed facilities.

As a result, this offers more flexible loan terms and considers the outstanding balance of the loan facility in alignment with the business’s growth projections.

As a consequence, this makes it the go-to choice for companies looking to secure capital for long-term development.

How Much Can I Borrow Under This Scheme?

The maximum amount you can borrow under this scheme depends entirely on your business’s turnover limit and the subsidy limits set by the government.

As a rough ballpark, loan amounts can range from £5,000 to £1 million pounds – subject to the scheme’s guidelines and your business’s eligibility, that is.

Is My Business Eligible if I’ve Already Taken Out a Loan?

If your business has already taken out a loan, you may still be eligible even if you have received a previous subsidy – or taken out a loan under other schemes.

However, you should note that the total amount of subsidies received over a rolling three-year period may affect the maximum amount you can borrow under the Growth Guarantee Scheme; we can help you with what you are eligible for when you get in touch.

How Quickly Can I Access Funds?

Once your application is approved by one of our accredited lenders, the funds can be disbursed to you in as little as a few days.

What is the Repayment Structure for Loans Under this Scheme?

The repayment structure for loans under this scheme is typically more flexible, with better terms than standard loans.

For instance these can include lower interest rates and extended repayment periods – especially for term loans tailored to your business’s cash flow and growth plans as well.

Drive Your Business Growth with the Growth Guarantee Scheme

As you can see, the Growth Guarantee Scheme is a very powerful business support tool provided by the HM Government and is facilitated through institutions like the British Business Bank plc.

As it is aimed to support business growth by making loans more accessible and providing you with more financial backing while at the same time reducing the risk for financial institutions to do so.

Consequently, as businesses continue to grow and expand, this scheme is aimed to play a key role in fuelling the UK economy’s long-term success for a while as a result.

Contact us

Ready to take your business to the next level?

Contact us today to discuss your funding options, as our team of experts is here to help you find the right loan for your business needs.

Who Is V4B Business Finance?

Here at V4B Business Finance, we specialise in providing comprehensive corporate funding solutions to UK businesses.

Consequently, this means that we can offer you a wide range of financial products including business loans, equipment finance, VAT funding, short-term loans, and many more business

finance solutions.

With over 30 years of experience, V4B Business Finance LTD is a business credit broker and not a lender, and we are authorised and regulated by the Financial Conduct Authority (FCA) and the ICO in England & Wales.

Consequently, we pride ourselves on delivering your company-tailored financial solutions that support your business growth and development.

Please note: Our finance options is available for business customers only, for limited companies and for corporate customers only.

Related Asset Finance News

As we all know, in today’s fast-paced business world, having the right tools and equipment really is more than crucial. So you have heard of this type of finance, but, what is Asset Finance...

Here at V4B Business Finance, we take pride in supporting businesses of all shapes and...

When you are running a business – whether you are a Sole Trader, limited company, or just setting up shop – getting your hands on the right tools, vehicles, or business assets can be pricey, and we understand this. That is where asset financing comes in...

When it comes to funding large projects or buying big-ticket equipment, businesses often need to look beyond their own pockets. That is where finance options like asset finance and project finance come into their own....

When it comes to funding a business, there really is no one-size-fits-all approach, and every business has different needs as well as faces different challenges. As a result, two popular finance options that often get mixed up are Asset Finance...

Meet the Team Behind Business Finance